Fundraising Demystified: The Crypto Edition

Why tokens are a VC's best friend, how tokenization is a double-edged sword for founders, and the importance of finding a path to sustainable growth.

In my previous post, "Fundraising Demystified: Navigating Conversations with VCs," I breakdown the VC business model and shared insights on what investors look for in potential investments. While the core principles remain the same for crypto projects, the introduction of tokens adds a new dimension to fundraising considerations. In this piece, we'll explore the allure of tokenization for VCs, the challenges of tokenizing for projects, and the importance of finding a path to sustainable growth.

The Token Advantage for VCs

Just like traditional VCs, crypto investors are driven by the pursuit of significant returns. However, the instant liquidity offered by tokens is a game-changer. Internal Rate of Return (IRR), a key metric for VCs, is a function of both the total return and the time period over which it is achieved. By allowing VCs to realize returns much faster compared to equity investments, tokens can significantly boost IRR, making them an extremely attractive option for investors.

Moreover, tokenization is often the most viable exit strategy for multi-billion dollar crypto outcomes. While traditional startups can aim for acquisitions or IPOs, such opportunities are scarce in the crypto world. Apart from a handful of notable acquisitions, like Nike's acquisition of RTFKT, and the rare IPO success story like Coinbase, tokens represent the most promising path to liquidity for crypto VCs.

As a result, VCs often gravitate towards Simple Agreement for Future Tokens (SAFTs), recognizing the potential for faster liquidity in a market where alternative exit options are few and far between.

The Founder Conundrum

For crypto founders, particularly those in the B2B space, the limited exit options can be a double-edged sword. Tokenization may not always align with their business model, putting them at a disadvantage when seeking VC investment. Additionally, the market for enterprise buyers in web3 is significantly smaller compared to the vast web2 enterprise landscape, constraining the Total Addressable Market (TAM) for B2B crypto startups that opt-out of tokenizing.

Tokens can be a powerful tool for bootstrapping networks, incentivizing early adopters to invest their time and resources before a project reaches product-market fit (PMF). However, over-reliance on tokens without a clear path to delivering real utility can lead to unsustainable growth and significant downturns in token valuations.

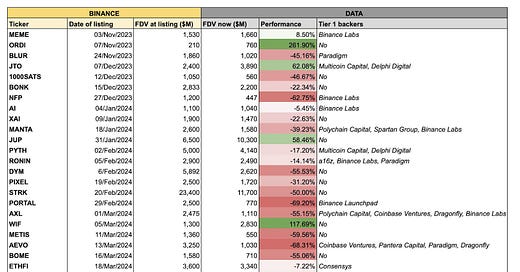

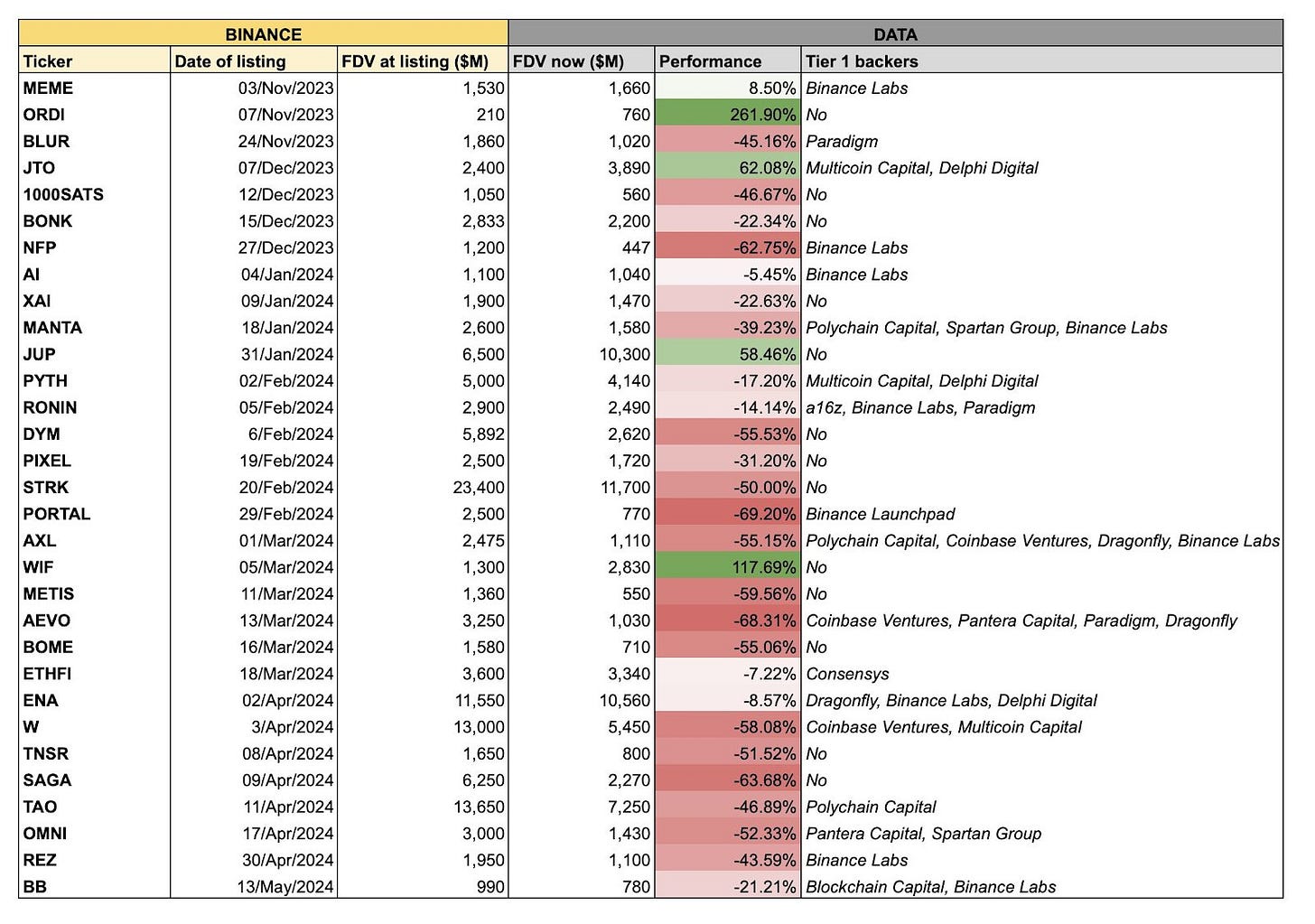

When a company IPOs, the market has fundamental ways to assess its potential based on current performance and growth prospects. With tokens, speculation and the failure to cross the crypto chasm – or finding real product-market fit – have led to significant downturns in token valuations. Many tokens are down bad, and while there are numerous discussions on X about the reasons behind this, founders must recognize that tokens alone are not a panacea.

Crossing the Crypto Chasm

Crossing the crypto chasm – the critical transition from early token farmers to mainstream users – is a make-or-break challenge for crypto projects. In my essay "Crossing the Crypto Chasm: Navigating the Hot Start Problem for Sustainable Growth," I explore the "hot start problem" faced by many token-based projects. The allure of quick liquidity and speculative hype can create a false sense of success, masking the underlying need for genuine product-market fit.

To achieve sustainable growth, founders must understand the fundamental differences between early token farmers and mainstream users. Early token farmers may be drawn to novelty and potential financial gains, while mainstream users seek tangible benefits and real-world applications. Founders must weave a captivating narrative and deliver product that spans the chasm, shifting focus from token price movements to the enduring value of a product or network that tackles real-world challenges and creates lasting impact for users.

Tokenomics can serve as a powerful catalyst, incentivizing early adoption and network growth. However, they must be designed with the long game in mind, aligning incentives with the project's core value proposition and adapting as market conditions evolve.

Crossing the crypto chasm is an ongoing journey that requires a keen understanding of user needs, a willingness to iterate and adapt, and a relentless focus on delivering real utility. By prioritizing these factors and building trust with their community, founders can attract both investors and users, positioning their projects for enduring success.

The TL;DR

Tokenization has revolutionized the crypto fundraising landscape, providing VCs with faster liquidity and attractive returns. While tokens can be a powerful tool for bootstrapping network growth, they are not a replacement for real utility and product-market fit.

Crossing the crypto chasm – the critical transition from early token farmers to mainstream users – is the defining challenge for crypto projects. Founders must strike a delicate balance between leveraging tokenomics for initial traction and relentlessly focusing on delivering genuine value to users.

Founders who can successfully navigate the challenges of tokenization, cross the chasm, and build products that solve real problems will not only attract funding, but build enduring projects that shape the future of decentralized technologies.

Looking for fundraising resources? Here is a curated reading list:

Fundraising Demystified: Navigating Conversations with VCs (Tina Dai)

Crossing the Crypto Chasm: Navigating the Hot Start Problem for Sustainable Growth (Tina Dai)

The Fundraising Wisdom That Helped Our Founders Raise $18B in Follow-On Capital (First Round Review)

This VC Pitch Deck Template Comes Recommended by First Round Capital

We Analyzed 5000 Token Unlocks – This is What We Found (6MV)