Crossing the Crypto Chasm: Navigating the Hot Start Problem for Sustainable Growth

In this piece, we dive into the implications of launching tokens pre-product market fit and explore tactics that might help projects cross the chasm to more sustainable growth.

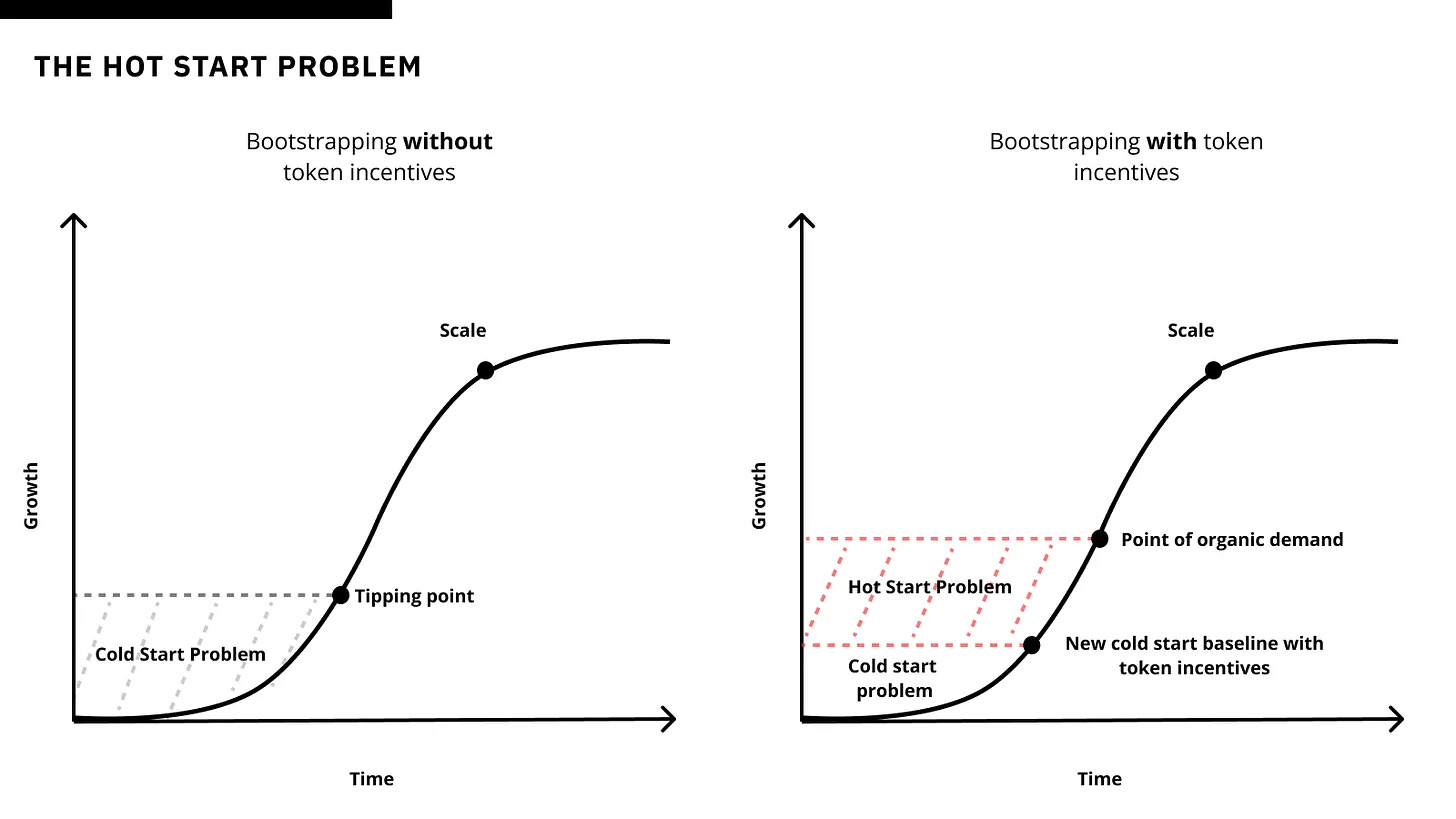

In the world of crypto, the "hot start" - aka launching a token to jumpstart growth - has become a popular strategy for new projects looking to gain traction quickly. My friend and fellow investor, Mason, recently explored this concept, shedding light on why some projects opt for this approach. But as with all things in crypto, the hot start is a double-edged sword. In this piece, we dive into the implications of launching tokens pre-product market fit and explore tactics that might help projects cross the chasm to more sustainable growth.

Why Projects Choose the Hot Start Problem

Mason's article laid out the allure of the hot start problem. In essence, it's about leveraging tokens – or even the promise of tokens – to overcome the classic cold start problem that plagues new networks and marketplaces.

Source: The Hot Start Problem (Mason Nystrom)

Mason proposes the strategy is particularly effective in two scenarios:

Red ocean markets: In highly competitive spaces with known demand, tokens can help second movers quickly bootstrap liquidity and user bases. Think of GMX and dYdX in the perpetuals market, or Blur's meteoric rise in the NFT trading space. More recent successes have used points for bootstrapping LRTs, lending platforms (e.g. Morpho), and bridges (e.g. Layer0).

Passive supply-side networks: When the jobs to be done are primarily passive – staking, providing liquidity, or running set-it-and-forget-it hardware – tokens have shown to be powerful motivators. Examples here include Grass or Morpheus.

The hot start, fueled by speculation and FOMO, can indeed kickstart network effects. But here's where things get tricky.

The Pitfall: Token Market Fit ≠ Product Market Fit

While a surging token price initially might feel like victory, it's crucial to recognize that token market fit is not the same as product market fit. Token market fit is simple: prices go up in the long run because more people believe they will rise than fall. Blue chip tokens like Bitcoin and Ethereum exemplify this, showing remarkable price appreciation over time from their abilities to attract consistent bag holders.

Product market fit, however, is about creating real, sustainable value through product enhancements and community. It's the difference between holding a token for price speculation versus using a product that solves real problems. Bitcoin and Ethereum successfully navigated this transition: Bitcoin by cementing its role as digital gold, and Ethereum by creating genuine network utility that incentivizes developers and users to engage with its ecosystem beyond mere speculation.

Most projects never transition successfully from token to product market fit. This disconnect can be dangerous, potentially masking a lack of genuine utility and leading to unsustainable, speculation-driven growth. Teams might find themselves catering to token holders rather than actual users, leading to skewed priorities and potentially unsustainable growth driven by speculation and marketing hype.

Crossing the Crypto Chasm: From Token Market Fit to Product Market Fit

The hot start might ignite the flame, but it's the quality of the fuel – your product and community – that will keep the fire burning. To build a sustainable crypto project, evolving from pure token market fit to a blend of token and product market fit is crucial, yet rare. This mirrors the concept of "crossing the chasm" in tech adoption, popularized by Geoffrey Moore.

If you're committed to the hot start approach, strategic tokenomics can buy you time to cross the product-market fit chasm. The key is orchestrating a delicate balance between token supply and demand, while strategically evolving tokenomics to align closely with product and network success. This approach aims to create a symbiotic relationship where token value becomes increasingly tied to genuine utility and adoption metrics, rather than pure speculation. As the project matures, tokenomics should transition from initial growth catalysts to sustainable, value-driven mechanisms that directly reflect and reinforce the ecosystem's health and expansion.

Here are some tactics to consider as projects aim to cross the crypto chasm and transition from attracting speculators in search of genuine utility for a broader user base:

Initial Launch:

Evangelize a Compelling Narrative: In crypto, a compelling story can be as powerful as the technology itself. Craft a story that ties your token roadmap to real-world impact or product advancement, attracting mission-driven early adopters. Remember, people invest in stories they believe in; a well-told narrative can turn token holders into passionate advocates, driving both adoption and long-term commitment to your project's success.

Strategic Low Float (with caution): Launch with a limited token supply to generate initial buzz and value, while reserving a significant portion for future incentives. This approach sacrifices immediate capital raised for greater long-term control over token distribution, allowing for sustained user acquisition and retention as the project evolves towards product-market fit. However, be aware that low float makes tokens highly reflexive to market conditions. This can lead to extreme volatility, potentially making the token behave like a meme asset until significant product traction is achieved.

Targeted Tiered Airdrops: Strategically distribute your initial token allocation to users who align with your project's long-term vision. Prioritize potential contributors, such as developers, content creators, or active community members, over likely short-term speculators. Implement a tiered system where different user categories receive varying amounts based on their potential value to the ecosystem. Clearly communicate the criteria for future airdrops once your token is in the market, creating a roadmap for continued engagement and rewarding behaviors that contribute to your project's growth and success.

Initial Staking Incentives: Implement a staking system with higher initial rewards that decrease as network participation grows. This approach, commonly seen in DePin projects, incentivizes early holders to maintain their positions, reducing sell pressure and fostering a committed core user base.

Liquidity Bootstrapping: Focus on creating efficient, well-balanced liquidity pools that facilitate organic trading activity, while preserving the majority of the token supply for future ecosystem development and user incentives. To kickstart liquidity, consider offering token rewards to users who participate in liquidity provision.

Introduce Basic Token Utility: Implement simple, clear use cases for your token at launch, ensuring immediate value within your ecosystem. Keep it simple: for example, holding X tokens could grant access to Y benefits (e.g., an exclusive NFT, future allowlist spots, or special user status). This approach ensures that even at the outset, your token has tangible utility, encouraging adoption and retention while laying the groundwork for more complex use cases as your project evolves.

Crossing the Chasm:

Adaptive Supply Schedule: Develop a transparent, flexible token supply schedule that responds to network growth and product milestones. This approach ensures token supply grows in tandem with genuine ecosystem development, incentivizing meaningful user engagement rather than mere speculation.

Tokenomics Tied to Product Success: Strategically expand token use cases as your product matures, transitioning towards models where token value directly correlates with product usage and network growth. Examples include implementing buy-back mechanisms, revenue sharing, or burn protocols. Projects like MakerDAO, Lido, and select exchange tokens demonstrate how tokenomics that are financially tied to the success of the product often benefit more from hot start. Consider integrating your token into a broader loyalty program that rewards both holding and active platform engagement, creating a symbiotic relationship between token value and ecosystem health.

Tiered Staking Incentives: Implement a multi-layered system rewarding long-term holding and active participation. This could include node sales with increased upfront costs, encouraging longer-term commitment. Offer escalating benefits such as enhanced governance rights, higher yields, or exclusive features based on holding duration and engagement level.

Community Cultivation: Foster a user base that believes in your project's long-term vision, not just short-term gains. However, be aware that even the most passionate community has a "price-based half-life" – their enthusiasm will wane if the token price doesn't eventually reflect the project's success.

Strategic Partnerships: Forge collaborations that enhance your ecosystem's value proposition. Ideally these shouldn’t be only focused on partnerships for rewards because those are fleeting relationships. If token rewards are provided, one way to encourage continued value is around milestone based vesting.

These suggested tactics aim to balance price stability while buying projects time to achieve genuine product-market fit. The goal is to create a flywheel where token value and product utility reinforce each other, ultimately transitioning from speculative interest to sustainable ecosystem growth.

The Case for Post-PMF Token Launches

Given the risks of taking on the hot start problem, there's a strong argument for delaying token launches until after achieving product-market fit. Take Magic Eden, for instance. They built a successful NFT marketplace and established a strong user base before even considering a token. This approach allowed them to focus solely on product development and user acquisition without the distraction of token price fluctuations. When they finally teased their token, it breathed new life into their platform, reinvigorating user engagement and opening up fresh avenues for growth and ecosystem expansion.

A token launch is like making a fire, if you prepare enough kindling and the token accelerant works really well. If you don’t, you’re now working overtime to keep a dimly lit flame from going out.

By launching a token post-PMF, projects can:

Reward genuine users rather than speculators even if it means upsetting bad actors

Use the token as a growth accelerant for an already-proven product

Potentially navigate regulatory waters more smoothly, and leverage creative business models or value capture mechanisms

Leverage the token launch as a powerful marketing event for an established product

This strategy isn't without challenges – you might grow slower initially compared to hot-start competitors and you might stare at CoinMarketCap thinking “that could be us if we had a token”. But the trade-off is potentially more sustainable, organic growth and ultimately a more valuable network (and token).

The Future Belongs to Projects that Master The Art of Token-Enabled Growth

In the evolving crypto landscape, the path from token launch to sustainable growth is not a binary choice between hot starts and cold starts, but a spectrum of strategic decisions. The true challenge lies in orchestrating a delicate balance: leveraging tokenomics to catalyze initial traction while simultaneously building genuine utility and community engagement.

Successful projects will be those that view their token not as an end goal, but as a powerful tool in a broader ecosystem play. They'll create mechanisms that align speculative interest with real-world value creation, effectively using their token to bridge the chasm between early adopters and mainstream users. Ultimately, the projects that thrive will be those that master the art of token-enabled growth, using it to accelerate their journey towards true product-market fit rather than as a substitute for it.

Thanks to Mason Nystrom for feedback on this essay! The views expressed here are my personal opinions only and should not be considered as professional advice. Anyone considering creating or launching a token should consult with qualified legal professionals to ensure compliance with applicable laws and regulations.