Fundraising Demystified: Navigating Conversations with VCs

By understanding the VC business model and what investors are looking for, founders can better position themselves to secure the funding they need to turn their visions into reality.

For many founders, one of the most pressing challenges they face is fundraising. This blog aims to help founders navigate the complexities of fundraising by shedding light on what investors are looking for and how to effectively communicate your startup's potential.

The VC Business Model: Understanding the Dynamics

Venture capitalists (VCs) operate within a unique business model that necessitates significant returns to be considered successful. According to Cambridge Associates, VCs need to deliver returns of 4-5x their initial investments to be in the top quartile of funds. For instance, a $100 million fund must return $400-500 million within its typical lifecycle of 5-8 years to meet this benchmark.

VCs operate under the power law, where a small number of investments yield outsized returns while the majority may fail or provide modest returns. Typically, less than 20% of a fund's investments generate meaningful returns. This means a VC's few successful investments must compensate for the rest, requiring these few to yield substantial returns.

Consider a fund that raises $100 million and invests it across 20 companies. If only 4 of these companies achieve successful exits, the VC's position in each must average $125 million in returns. Assuming the VC owns around 10% of each company at exit, each of these companies must reach a valuation of at least $1.25 billion, essentially becoming unicorns.

This model explains why VCs are often on the lookout for unicorns—startups valued at over $1 billion. Unicorns represent the potential for these outsized returns and can determine the success of a VC fund. Understanding this dynamic is crucial for founders, as it underscores the importance of demonstrating significant growth potential in their pitches.

What VCs Look For

Given the high stakes, VCs have developed specific criteria to evaluate potential investments. Founders need to address three key questions to attract investor interest.

First, investors are drawn to startups that offer a unique perspective or innovative solution to a problem. This could be a new technology, a novel business model, or a fresh take on an existing market. Articulating your unique insight clearly and compellingly is crucial.

Second, the market size is a critical factor for investors. They seek opportunities in large or rapidly growing markets that can support significant scale. For a company to be valued at $1.25 billion, it must operate in a market capable of supporting substantial revenue. Typically, in public markets, the revenue multiple is around 10x, meaning a company must achieve approximately $125 million in yearly revenue to reach a $1.25 billion valuation. Demonstrating a deep understanding of your target market and its potential can set your pitch apart.

Finally, even the best ideas need the right team to execute them. Investors look for founders with relevant experience, complementary skills, and a track record of resilience and adaptability. Highlighting the strengths of your team and their alignment with the startup's vision can build investor confidence.

Know Your Investor to Craft the Best Pitch

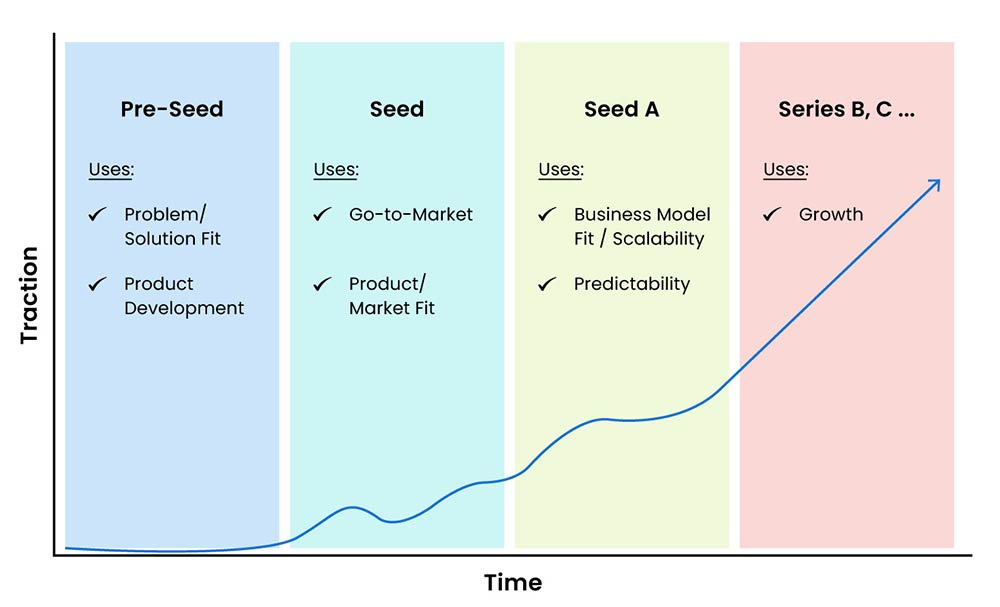

Fundraising is a subjective and multifaceted process that varies across different stages of a startup’s lifecycle. While the main points discussed—unique insight, market size, and team strength—are critical, other factors such as market conditions and each VC fund’s mandate also play a role. Different VCs at various stages of investment may prioritize different characteristics, and funds often have specific focuses such as B2B or crypto.

Source: Dealroom

All of this to say: it is essential for founders to research their potential investors thoroughly. By understanding the VC business model and what investors are looking for, founders can better position themselves to secure the funding they need to turn their visions into reality. Embrace the journey, stay resilient, and remember that each pitch is an opportunity to refine your story and grow your network.